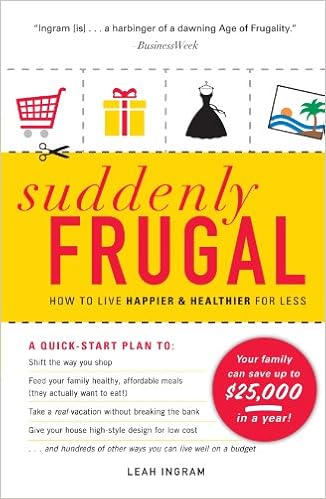

By Leah Ingram

ISBN-10: 1440512949

ISBN-13: 9781440512940

Many folks be aware of one or issues they could do to save cash, like reducing on holidays and nutrition out, yet past that, they're stumped. once they examine their present way of life, they've got no concept the place they could trim the fats with out sacrificing their caliber of life.

That's precisely what this advisor will do. it's going to assist you establish small, painless adjustments you can also make in your day-by-day conduct which could upload as much as large savings—while bringing you nearer as a relations. through grouping those money-saving suggestions right into a room of the home or errand on a to-do checklist, you could instantly positioned your abruptly frugal plan into action—and immediately start saving money.

By pinpointing the greenback quantity linked to every one cost-saving step, monetary whiz and mother Leah Ingram will motivate you to embrace—and enjoy—your new frugality.

Read Online or Download Suddenly Frugal: How to Live Happier and Healthier for Less PDF

Similar personal finance books

Effortless Quicken teaches you ways to exploit Quicken to prepare and deal with your monetary info. you will how to arrange and music checking and reductions money owed, investments, and pay accounts on-line, with no need to spend time studying loads of textual content. as a substitute, this e-book makes use of plenty of full-color screenshots and step by step directions to coach you greater than a hundred vital initiatives.

The New Masters of Capital: American Bond Rating Agencies and the Politics of Creditworthiness

Within the New Masters of Capital, Timothy J. Sinclair examines a key point of the worldwide economy-the ranking organizations. within the worldwide economic climate, belief is formalized within the day-by-day operations of such corporations as Moody's and traditional & Poor's, which consistently display screen the monetary well-being of bond-issuers starting from inner most organizations to neighborhood and nationwide governments.

52 Weeks to Financial Fitness. The Week-by-Week Plan for Making Your Money Grow

Fifty two Weeks to monetary health is your own monetary coach -- a pleasant and authoritative specialist that would consultant you week by way of week to regulate your funds and make your funds develop. within the present frenzied industry it is not easy to grasp whom to show to for good recommendation. Into this void steps the calm presence of Marshall Loeb, own finance pioneer and previous editor of 2 of the main winning magazines in background, Fortune and funds.

Detect the facility of KAIZEN to make lasting and robust switch on your association “Maurer makes use of his wisdom of the mind and human psychology to teach what i've got promoted for the earlier 3 decades—that non-stop development is equipped at the beginning of individuals courageously utilizing their creativity.

- The sun still shone: professors talk about retirement

- QuickBooks 2009 All-in-One For Dummies

- Dollars & Sense for Kids, 1999

- Stability of buildings

Additional info for Suddenly Frugal: How to Live Happier and Healthier for Less

Example text

Public schools—referred to, importantly, as "common schools"—were created around the nation during the antebellum period. During the Civil War, the Homestead Act provided 160 acres of free public land to settlers willing to live on it and improve it for at least five years. "Land grant" public universities ensured access to education and technical knowledge for ordinary citizens. Economic development was furthered through the subsidizing of railroads, while the Army Corps of Engineers built much of the infrastructure in the Western states.

Almost half of today's elderly would live in poverty without these programs. S Despite recent fears, Social Security remains the most popular and universally used program in American history. One-quarter of people sixtyfive years old and older depend on it for at least 90 percent of their income; 60 percent count on it for at least half. S Social Security is very efficient: Administrative costs are 1 percent of benefits, versus 12 to 14 percent for private insurance. 20 Social Security and the Middle-Class Squeeze S Social Security retirement benefits are portable.

More than 8 percent of homeowners now spend at least half their income on their The Middle Class and the American Dream 31 mortgage. S. " The legislation, rejected a number of times by Congress since the late 1990s despite the best efforts of credit card companies, makes it much harder for families to file for Chapter 7 bankruptcy. Chapter 7 allows debtors to erase their obligations after forfeiting a state-determined percentage of their remaining assets. Bankruptcy courts previously had broad discretion to decide who can file for it, or for Chapter 13, which has much less generous terms.