By Henry N. Butler

ISBN-10: 0844771945

ISBN-13: 9780844771946

The Sarbanes-Oxley Act of 2002 (SOX) is a immense failure, poorly conceived and rapidly enacted in the course of a regulatory panic. proof means that the industry has anticipated that SOX will impose large oblique bills on most sensible of considerable direct charges. A mostly missed situation is the act’s power to show right into a litigation time bomb: the 1st significant industry correction will most likely develop into a ceremonial dinner for trial attorneys. SOX’s defenders assert that the company global is healthier off now than earlier than SOX, however the suitable query is whether or not it really is larger due to SOX. present associations can have replied to any difficulties and not using a sizeable one-size-fits-all legislation from the government. SOX might be repealed, yet failing that, there's a few desire fresh lawsuit may provide the leverage to enact not less than a few significant alterations. the industrial expenditures of SOX might be drastically lowered by way of prohibiting inner most proceedings in keeping with SOX, exempting all however the greatest household enterprises and dual-listed securities of overseas firms, and clarifying and lowering the necessities of SOX’s debatable inner controls disclosure requirement. The post-SOX period deals possibilities to evaluate soberly what we've discovered approximately policymaking from the SOX fiasco. there's a lot to be acknowledged for cautious legislation that acknowledges legislators’ inherent obstacles in reforming company governance. The Sarbanes-Oxley Debacle seeks to salvage a few classes from the ruins of SOX. The AEI legal responsibility reviews research elements of the U.S. civil legal responsibility method imperative to the political debates over legal responsibility reform. The objective of the sequence is to give a contribution new empirical facts and promising reform rules which are commensurate to the seriousness of America’s legal responsibility difficulties.

Read Online or Download The Sarbanes-Oxley Debacle: What We've Learned; How to Fix It (Aei Liability Studies) PDF

Best legal history books

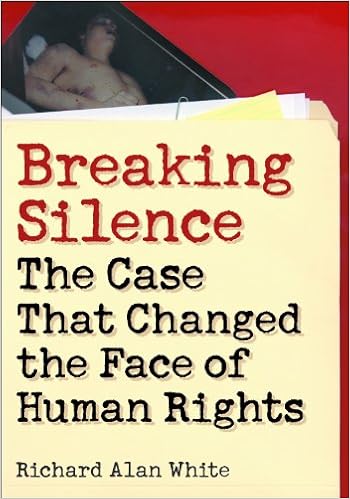

Breaking Silence: The Case That Changed the Face of Human Rights (Advancing Human Rights)

Younger seventeen-year-old Joelito Filártiga used to be taken from his kin domestic in Asunción, Paraguay, brutally tortured, and murdered by means of the Paraguayan police. Breaking Silence is the interior tale of the search for justice by way of his father—the real objective of the police—Paraguayan artist and philanthropist Dr.

The Enemy of All: Piracy and the Law of Nations

The philosophical family tree of a extraordinary antagonist: the pirate, the key to the modern paradigm of the common foe.

Tyrannicide: Forging an American Law of Slavery in Revolutionary South Carolina and Massachusetts

Tyrannicide makes use of an enthralling narrative to unpack the reviews of slavery and slave legislations in South Carolina and Massachusetts through the innovative period. In 1779, in the course of the midst of the yankee Revolution, thirty- 4 South Carolina slaves escaped aboard a British privateer and survived numerous naval battles until eventually the Massachusetts brig Tyrannicide led them to Massachusetts.

New Essays on the Normativity of Law

H. L. A. Hart as soon as argued idea suppressing the normative portion of legislation "fails to mark and clarify the the most important contrast among mere regularities of human habit and rule-governed habit. " this can be a severe quandary for a thought of legislations, considering a massive a part of the felony area is worried with rule-governed behavior and will be expressed purely through use of such notions as norm, legal responsibility, accountability, and correct.

- Domestic and International Trials 1700-2000

- The Halal Frontier: Muslim Consumers in a Globalized Market

- How Progressives Rewrote the Constitution

- Landmark Supreme Court Cases: The Most Influential Decisions of the Supreme Court (Facts on File Library of American History)

Additional info for The Sarbanes-Oxley Debacle: What We've Learned; How to Fix It (Aei Liability Studies)

Sample text

But shareholders are assumed to own a portfolio of stocks through which they diversify many different risks, including the risks of managerial ineptitude, managerial entrenchment, accounting and other fraud, self-dealing, and lawsuits. Thus, through diversification, shareholders can minimize their costs of bearing the risk of fraud. A corollary is that attempting to eliminate all managerial malfeasance would actually hurt diversified shareholders by requiring managers to devote resources to reducing risks that shareholders can deal with cheaply on their own.

But once that had been done, the warning signs were in the open, inviting more careful investigation and evaluation. Perhaps curious analysts would have hit stone walls within the companies, but the absence of information (and a company’s unwillingness to provide it) suggests the presence of risk which, in turn, is reflected in the market price. Moreover, even if more disclosure, or perhaps the barring of suspect practices, would have prevented Enron and other frauds, it is not clear that such regulations will prevent the next fraud—which will not be about special-purpose entities or derivatives, but probably about some other practices that neither the markets nor Congress can now anticipate.

SOX, in effect, represents a political judgment that less risk of fraud or bad business outcomes is necessarily good for society. Some social costs are attributable to the disproportionately high costs SOX imposes on smaller companies, discussed in the next section. The problem can arise, however, because of burdens imposed on larger firms as well. First, the disproportionate compliance costs per dollar of capitalization for smaller firms impose social costs by discouraging startup ventures. The venture capital market is built on the assumption that successful startups financed by venture capital ultimately will exit from the venture phase into the public securities markets.